Hello, Hope your Late September is going well! Here’s the news, listings, open houses, events and more! Reach out if you have any specific questions! Enjoy!

Phoenix-Area Real Estate News

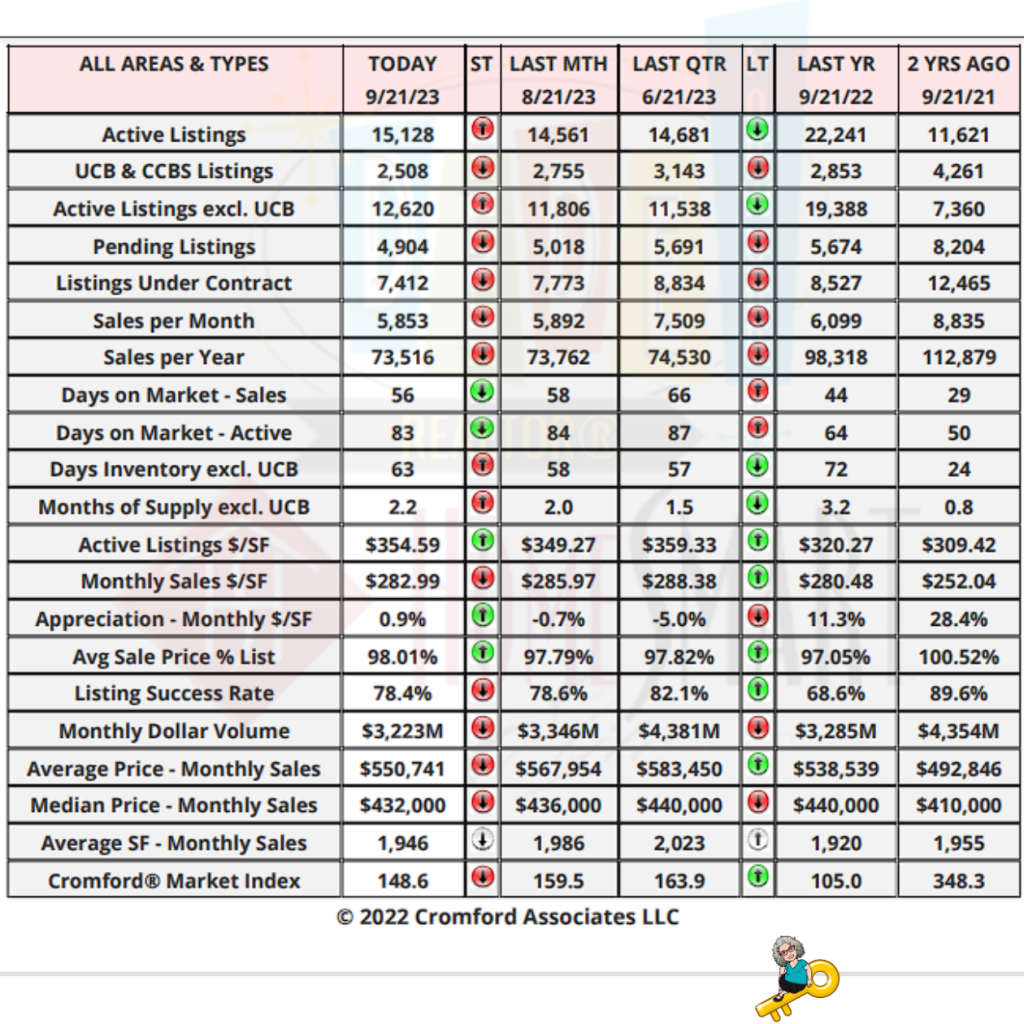

Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities. This week we have only 2 cities that moved in a direction favorable to sellers over the last month, with Paradise Valley reversing and only Cave Creek and Tempe left. If we look at the change over the last week, even Tempe & Cave Creek have deteriorated for sellers.

We can safely conclude that the market is becoming more favorable to buyers at an accelerating rate. The average CMI change in these 17 cities over the last month was -7.8%, more negative than last week when we measured -5.9%.

Most negative again this week is Chandler, down 26%, though it remains comfortably in first place. Goodyear and Gilbert are also much weaker than this time last month.

13 out of 17 cities are sellers markets with Buckeye. Goodyear, Queen Creek and Maricopa in the balanced zone. Three of the cities are now below the 100 mark implying that buyers have a slight edge in negotiations in these three cities.

All these observations apply primarily to the re-sale market. The new home market remains more favorable to sellers – the homebuilders are comfortably in charge.

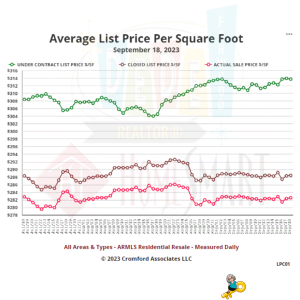

Dollars per Square Foot:

The average $/SF for the list price of those same closed listings is even more stable. It started at $288.33 and ended at $288.46. Note that this went up very slightly while the average sale price went down very slightly, confirming that listings are closing for a marginally lower percentage of list than 2 months ago.

Meanwhile the average $/SF for listings under contract has been rising over the last month after falling for the month before that. It now stands at $313.72 after starting at $308.40 and dipping to $304.02. This is a consequence of the luxury market waking up after its sleepy summer season.

The gap between the green line and the brown line in the chart is now too wide, suggesting that closed pricing will probably rise between now and October 18.

Concise Market Snapshot

Valley of the Sun Sold Listings

- 7050,7601,6318,6209,5731,5487,5833,5158,5583,4731,5817,6954

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Inventory

- 19843,20237,20564,20332,20280,21356,23131,24233,23020,23573,25736,27535

- 9621,9474,8192,7689,8817,9001,9409,7451,6073,11120,10466,11294

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings

- 9621,9474,8192,7689,8817,9001,9409,7451,6073,11120,10466,11294

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Pending Listings

- 7188,6637,5977,5646,5598,5649,5604,5050,4530,6303,6642,6494

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Absorption Rate

- 3.32,3.37,3.45,3.46,3.44,3.65,3.96,4.11,3.88,3.93,4.28,4.57

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Sale to Original List Price Ratio

- 96.1,96.2,96.1,96.0,95.6,95.8,96.0,95.8,95.3,95.4,95.8,95.8

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Average Days on Market

- 66.0,64.7,65.2,66.8,71.1,70.3,71.9,71.1,75.7,81.5,80.0,77.7

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings Volume

- 6336656755,6070361412,4981802722,4528549389,5505279350,6181215417,6408533461,4990243000,3989362142,8348153311,7211801306,7764958223

Information is deemed to be reliable, but is not guaranteed. © 2025

BankRate Mortgage Rates:

On Friday, September 22, 2023, the current average 30-year fixed mortgage interest rate is 7.75%, up 24 basis points over the last week. If you’re looking to refinance your current loan, today’s current average interest rate for a 30-year fixed refinance is 7.86%, increasing 17 basis points from a week ago. Meanwhile, today’s current average 15-year refinance interest rate is 6.91%, up 6 basis points compared to this time last week.

New Listings:

New to the Market

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Upcoming Open Houses:

Open Houses this Weekend

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

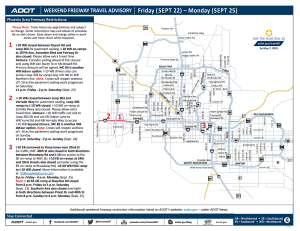

ADOT’s Weekend Freeway Travel Advisory- Phoenix Area:

ADOT’s Weekend Freeway Travel Advisory (Sept. 22-25) – Phoenix Area – Plan on closures along I-10 in the Goodyear-Buckeye area

PHOENIX – Improvement projects will require closures or lane restrictions on a few sections of Phoenix-area freeways this weekend (Sept. 22-25), according to the Arizona Department of Transportation. Drivers should allow extra travel time and plan detour routes if necessary while the following weekend restrictions are in place:

- Westbound Interstate 10 closed between Dysart Road and Loop 303 in the West Valley from 11 p.m. Friday to 2 p.m. Saturday (Sept. 23) for pavement sealing. Westbound I-10 on-ramps at 107th Avenue, Avondale Boulevard and Fairway Drive also closed. Please allow extra travel time. Detours: Consider exiting ahead of the closure and using westbound Van Buren Street or McDowell Road. Primary detours will be signed. Westbound MC 85 is another detour option. Westbound I-10 drivers also can access northbound Loop 303 by using northbound Loop 101 to westbound Northern Avenue.

- Note: Crews will reopen sections of I-10 as the pavement sealing work progresses on Saturday.

-

Westbound I-10 closed between Loop 303 and Verrado Way from 11 p.m. Saturday to 2 p.m. Sunday (Sept. 24) for pavement sealing. Loop 303 ramps to westbound I-10 closed. Westbound I-10 on-ramp at Estrella Parkway also closed. Please allow extra travel time.

-

Detours: Westbound I-10 traffic can exit to southbound Loop 303 and use southbound Cotton Lane to westbound Yuma Road and northbound Verrado Way to access westbound I-10 beyond the closure. Westbound MC 85 is another detour option.

-

Note: Crews will reopen sections of I-10 as the pavement sealing work progresses on Sunday.

-

-

Eastbound I-10 narrowed to three lanes near 32nd Street from 8 p.m. Friday to 4 a.m. Monday (Sept. 25) for traffic shift. 40th Street closed in both directions between Broadway Road and I-10 (no access to the eastbound on-ramp at 40th Street). Eastbound I-10 on-ramps at 24th and 32nd streets also closed (consider using the eastbound on-ramp at Broadway Road). The westbound US 60 HOV ramp to westbound I-10 also will be closed. For more information please visit I10BroadwayCurve.com.

-

Note: Eastbound I-10 off-ramp at Baseline Road closed from 8 p.m. Friday to 5 a.m. Saturday (Sept. 23). Consider exiting at Elliot Road. Southern Avenue also closed overnight in both directions between Priest Drive and 48th Street from 8 p.m. Sunday to 4 a.m. Monday (Sept. 25).

-

Schedules are subject to change due to inclement weather or other factors. ADOT plans and constructs new freeways, additional lanes and other improvements in the Phoenix area as part of the Regional Transportation Plan for the Maricopa County region. Most projects are funded in part by Proposition 400, a dedicated sales tax approved by Maricopa County voters in 2004.

Real-time highway conditions are available on ADOT’s Arizona Traveler Information site at az511.gov and by calling 511. Information about highway conditions also is available through ADOT’s Twitter feed, @ArizonaDOT.

National Real Estate News

Real Estate News in Brief

The Fed did nothing (kept rates on hold) and still shook up everything (by forecasting stronger economic growth and higher interest rates). Average 30-year mortgage rates are back near their recent peak, and transaction volumes are dropping…but home prices keep grinding higher in most markets.

The Federal Reserve chose to keep rates steady. That’s the second ‘skip’ this year. But Fed Chairman Jerome Powell gave no indication that the Fed was ready to ‘stop’. GDP forecasts were raised and unemployment forecasts cut. And Fed members’ anonymous ‘dot plot’ forecasts suggested one more rate hike this year and only two cuts next year.

Predictably, the Treasury and Mortgage Backed Securities markets hated the Fed’s new forecasts and commentary. Anything that suggests ‘higher for longer’ rates brings the sellers out in force. As a result, average 30-year mortgage rates moved to within 2 bps of the recent peak of 7.49%.

Builder confidence fell for the 2nd-straight month in September, with the National Association of Homebuilder’s Housing Market Index dropping below 50 (bearish territory) for the first time since December 2022. [NAHB]

Housing starts slowed (and shifted). Total housing starts fell 11% MoM to 1.3 million units (SAAR) in August. But single-family home starts (SFH) dropped just 4% MoM. The wave of multifamily (MF) construction is cresting. [BEA]

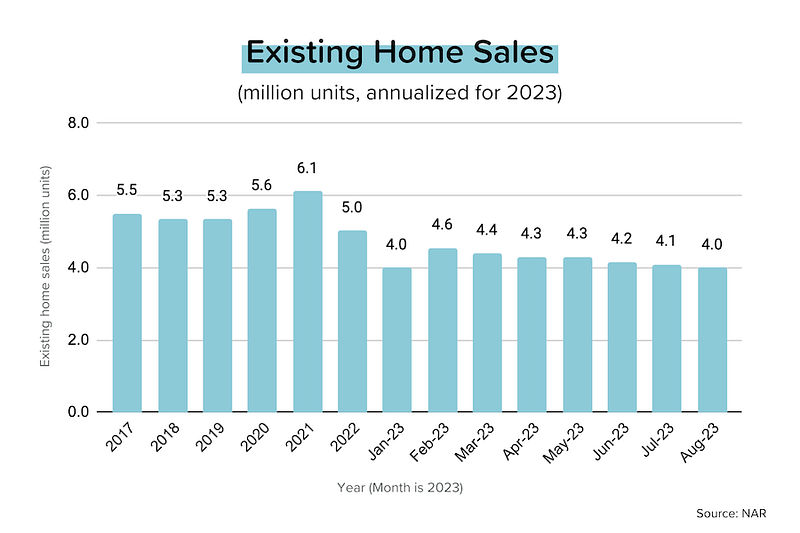

Existing home sales for August dropped slightly MoM to 4.0 million units (SAAR). Median sales prices, however, rose slightly MoM to $407,000 and are now up nearly 4% YoY. [NAR]

Zillow reported that its Home Value Index (HVI) rose just 0.2% MoM in August, a big slowdown from the super-hot 1.2% MoM average home price growth experienced over the previous four months. 32 of the 50 largest metros set new all-time highs. [Zillow]

The property portal now forecasts a 4.9% increase in its HVI over the next 12 months. For the typically priced $400,000 home, that would generate nearly $20K in appreciation. Yes, home prices and mortgage rates are high. But so is the “cost of waiting”, when home prices are rising.

The Conference Board’s Leading Economic Indicators index fell 0.4% MoM in August. The LEI has now declined for 17 straight months. If we don’t end up getting a recession, nobody will pay attention to the LEI after this. [Conference Board]

Cancel culture redux? Redfin says that 60,000 home purchase agreements were canceled in August, equivalent to 15.7% of homes that went under contract that month. The last time the cancellation rate was this high was October 2022. Pre-pandemic, it ranged from 12–14%. [Redfin]

Barriers to Buying

This survey and report from the NAR didn’t get a lot of press, but I thought it was excellent. The objective of the report was to understand what barriers would-be homebuyers were encountering: from limited inventory to discrimination.

Main reason buyer hasn’t yet purchased:

- Can’t find enough homes in my budget — 34%

- Waiting for mortgage rates to drop — 18%

- Waiting for prices to drop — 9%

- Worried about being able to sell current home — 7%

- Concerned about competing with multiple offers — 5%

- Trouble getting approved for a loan due to credit issues — 4%

- Can’t save up enough for the down payment — 3%

Over a quarter of respondents are hoping that the market moves in their favor: lower home prices, lower mortgage rates, or both. But here’s the thing: home prices are moving UP pretty much everywhere. The modest decline in prices experienced in the second half of 2022 has largely been erased. As I’ve said many times: you know the cost of acting…but do you fully understand the cost of waiting?

Main issue stopping you from saving up for a down payment:

- No issue — 47%

- Current rent or mortgage payment — 23%

- Credit card balances/payment — 17%

- Student loan debt — 12%

- Car loan — 11%

28% of respondents said that credit card bills or car loan payments are keeping them from saving up for a down payment. The annual percentage rate on credit cards and car loans tend to be much higher than a mortgage — even at 7.5%! Consumers in this position should discuss a debt consolidation strategy with their lender. Even if they ‘give up’ a much lower mortgage rate, they could still save significantly on interest payments overall.

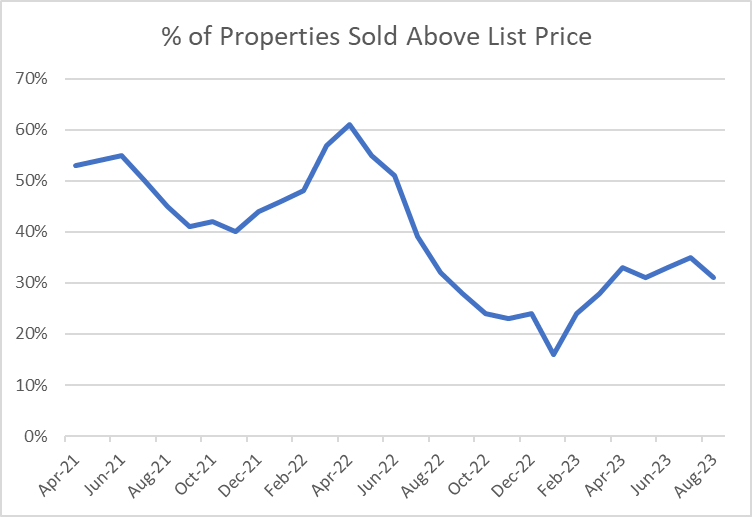

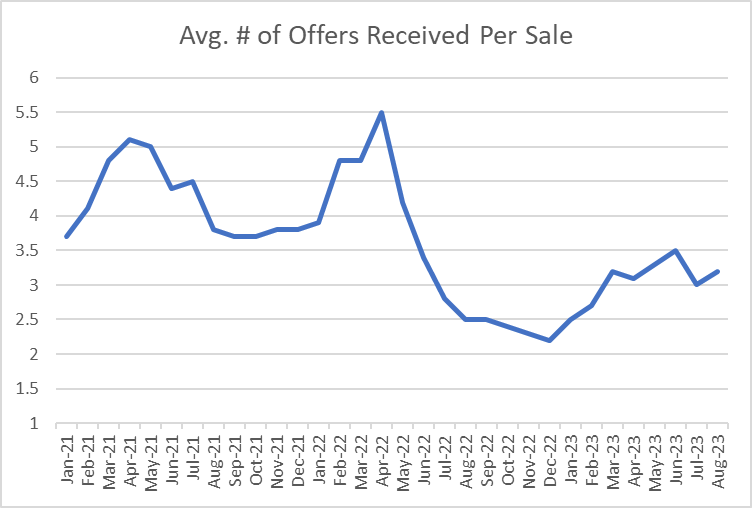

Realtors Confidence Index for August 2023

Confidence is clearly waning — but competition is not. Only 11% of the Realtors surveyed by the NAR expect an increase in buyer traffic over the next 3 months, and just 10% see an increase in seller traffic.

That said, the competition levels for the homes that ARE getting listed remains somewhere between ‘high’ and ‘fierce’ depending on the local supply/demand situation:

- The homes that were sold in August 2023 spent a median 20 days on the market

- 72% of the homes sold in August were on the market <1 month (that was 74% in July)

- First-time homebuyers made up 29% of total sales (about the same as last month)

- Cash sales made up 27% of total sales (about the same as last month)

- 31% of the homes sold in August were transacted above the listing price

- There were an average of 3.2 offers for each home sold in August.

What the Fed Said

Rates were kept on hold, with the federal funds rate still targeted to range from 5.25% — 5.50%. That’s the second ‘skip’ in the last three meetings, but Powell gave no indication that it could secretly be a ‘stop’.

If you read the press release, there was very little that was different from the last meeting, other than some adjective adjustment. To paraphrase:

- The economy is expanding at a “solid” pace (was “moderate” before)

- The job market is “strong” (was “robust” before)

- We’re watching the data to see if we’ll need to move rates higher

- Inflation is still too high

- Target is still 2%

In terms of their individual forecasts for where the fed funds rate will go:

- Median forecast for end-2023 is 5.6% (this didn’t change)

- That implies another +25 bps rate hike before year end

- And for end-2024, their median forecast is 5.1% — (was 4.6% previously)

- That means that they’re now looking for 2 rate cuts in 2024 (vs. 4 previously). The implication is that rate cuts will come later, if at all, in 2024.

If you add this all together, it looks like the Fed is in no hurry to cut rates. Inflation is moving in the right direction, albeit slowly, and there are no obvious signs of trouble in the job market or economy as a whole. Unfortunately for homebuyers (and real estate professionals) a ‘soft landing’ isn’t going to help mortgage rates.

Mortgage Market

What the Fed did: expected. What the Fed said: discombobulating. Two days of aggressive selling in the Treasury and MBS market helped send average 30-yr mortgage rates to within a whisker of the recent high of 7.49%. This is the opposite of what we need: lower mortgage rates would help with both affordability (obvious) and availability (fewer sellers feeling ‘locked in’).

Quick Math: At the current level of interest rates, the monthly principal and interest on a 30-yr loan works out to roughly $700 for each $100,000 of loan principal. So a $300,000 loan will require 3 X $700 = $2,100/month.

They Said It

“Home prices continue to march higher despite lower home sales. Supply needs to essentially double to moderate home price gains.” — Lawrence Yun, NAR’s Chief Economist

“With August’s decline, the US Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year.” — Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Here’s your links for this weekend’s events!

My Website always has a list of what’s upcoming. Go here and maybe I’ll see you out there!

Get your Home Value, wealth Snapshot and Ideas what to do with your Equity Every Month!

Join DeDe’s Secret Private Facebook group for tips, tricks, discounts and Freebies!

What’s going on with DeDe this week?

Still cleaning and decluttering! Got a new car battery (always at the most inconvenient time)! Thanks Sam, Cait, Jim, Mike and Laura for the assists!

My aesthetician – D’lisa at Salon D’shayn said “give me a year and I’ll fix your skin so I am! I got my 3rd RF Microneedling Thursday and next are some cool hybrid peels! Looking glowy, aren’t I?

Happy to get a beautiful Buckeye Home under contract on the first weekend!

That’s all for this week! Know I am always here for any questions you have about Buying, Selling, or Investing in Residential Real Estate! HomeOwnership too! Vendors and Tradespeople too! Don’t hesitate to Reach out

See you next Week!

DeDe