Here’s the news, listings, open houses, events and more! Reach out if you have any specific questions! Enjoy!

Phoenix-Area Real Estate News

Cromford Market Index

The market is still weakening and at a faster rate, with an average decline of 15.6% in the Cromford® Market Index for the 17 cities above. This is worse than the 14.5% decline we saw last week.

Well above average declines in CMI can be seen in Cave Creek, Buckeye, Scottsdale, Paradise Valley, Chandler, Peoria , Surprise, Phoenix and Mesa. Falling but at a lower speed are Gilbert, Avondale, Maricopa and Tempe.

11 out of 17 cities are still sellers markets with Peoria and Surprise in the balanced zone while Buckeye, Goodyear, Queen Creek and Maricopa are all buyers’ markets. Queen Creek has joined Buckeye below the 80 level. Among the secondary cities, Casa Grande is also below 80 while Gold Canyon and Litchfield Park are below 90.

Tolleson, Laveen, Anthem, El Mirage and Apache Junction are the strongest of the secondary cities with CMIs over 190.

Monthly Average Sales Price Per Square Foot

Although the market is weakening quickly, you couldn’t tell from the closed listing prices we are recording:

Breaking through the $293 level for the first time since July 12, 2022, this chart gives us the impression of a market in robust health.

This underlines the fact that sales pricing, even when measured every day, is very much a trailing indicator. Many of these prices were established in contracts agreed a few months ago when the Cromford® Market Index was still over 160, representing a strong seller’s market with declining inventory. Sales volumes have also held up better in the luxury market than at the opposite end of the market, where first time buyers are having difficulty affording a mortgage. This bias towards the higher end pushes the average $/SF upwards.

The leading indicators, such as the CMI, contract ratio, days of inventory and listing success rate are all reflecting the recent step down in demand and the rapid rise in active listings. This situation also shows us how poor the S&P / Case-Shiller® Home Price Index is in representing the current state of the market. Not only is the index a trailing indicator, it is 2 to 3 months behind the chart above because it uses a 3-month average for sales that closed between 2 and 5 months ago.

Active Listings

Active listing counts are rising at the second fastest rate we have ever witnessed for late October. Since the low point of 11,473 (excluding UCB and CCBS) in late July they have climbed almost 35% and are rapidly approaching 16,000. The only year which saw a faster rate was 2005:

Affidavit of Value

The Affidavit of Value recorded during October by Maricopa County have now been analyzed and show us the following:

- There were 5,543 closed transactions, down 8% from 6,019 in October 2022 and down 6% from September.

- There were 1,480 closed new homes, up 5% from 1,410 in October 2022 but down 9% from September.

- There were 4,063 closed re-sale transactions, down 12% from 4,609 in October 2022 and down 5% from September.

- The overall median sales price in October was $470,000, unchanged from October 2022 and up 4.4% from September.

- The re-sale median sales price was $445,000, down 0.6% from October 2022 but up 1.1% from September.

- The new home median sales price was $538,422, up 1.8% from October 2022 and up 12% from September.

New home sales have remained resilient and grew year over year, despite the extremely weak demand in the re-sale market.

Unlike the last 2 months, the new home numbers were not impacted by large buy-to-rent transactions with low unit prices. Consequently the new home median sales price jumped to $538,422, the highest we have ever recorded. These numbers are for single family and townhouse / condo homes.

Concise Market Snapshot

Monthly Average Sales Price Per Square Foot

We can see that Phoenix pricing has been much weaker than the national average between 3Q 2022 and 3Q 2023. Although the market is weakening quickly, you couldn’t tell from the closed listing prices we are recording:

Breaking through the $293 level for the first time since July 12, 2022, this chart gives us the impression of a market in robust health.

This underlines the fact that sales pricing, even when measured every day, is very much a trailing indicator. Many of these prices were established in contracts agreed a few months ago when the Cromford® Market Index was still over 160, representing a strong seller’s market with declining inventory. Sales volumes have also held up better in the luxury market than at the opposite end of the market, where first time buyers are having difficulty affording a mortgage. This bias towards the higher end pushes the average $/SF upwards.

The leading indicators, such as the CMI, contract ratio, days of inventory and listing success rate are all reflecting the recent step down in demand and the rapid rise in active listings.

This situation also shows us how poor the S&P / Case-Shiller® Home Price Index is in representing the current state of the market. Not only is the index a trailing indicator, it is 2 to 3 months behind the chart above because it uses a 3-month average for sales that closed between 2 and 5 months ago.

Cromford Market Index

Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The market is weakening at a faster rate, with an average decline of 14.5% in the Cromford® Market Index for the 17 cities above. This is worse than the 13.4% decline we saw last week.

Well above average declines in CMI can be seen in Cave Creek, Buckeye, Chandler and Mesa. Falling but at a lower speed are Gilbert, Avondale, Maricopa and Tempe.

12 out of 17 cities are still sellers markets with Surprise in the balanced zone while Buckeye, Goodyear, Queen Creek and Maricopa are all buyers’ markets. Buckeye has even slipped below the 80 level.

Average List Pirce per Sq Ft

The monthly average sales price per sq. ft. has just breached $290 to the upside, while the average $/SF for listings under contract remains comfortably above $320.

As we see inventory rise we also see more sellers cutting their asking price, but this has not filtered through to the chart.

Concise Market Snapshot

The table provides a concise statistical summary of today’s residential resale market in the Phoenix metropolitan area.

The figures shown are for the entire Arizona Regional area as defined by ARMLS. All residential resale transactions recorded by ARMLS are included. Geographically, this includes Maricopa county, the majority of Pinal county and a small part of Yavapai county. In addition, “out of area” listings recorded in ARMLS are included, although these constitute a very small percentage (typically less than 1%) of total sales and have very little effect on the statistics.

All dwelling types are included. For-sale-by-owner, auctions and other non-MLS transactions are not included. Land, commercial units, and multiple dwelling units are also excluded.

BankRate Mortgage Rates:

On Friday, November 03, 2023, the current average 30-year fixed mortgage interest rate is 7.94%, decreasing 10 basis points from a week ago. If you’re planning to refinance, today’s average interest rate for a 30-year fixed refinance is 8.05%, decreasing 13 basis points over the last seven days. Meanwhile, the current average 15-year fixed refinance interest rate is 7.41%, down 3 basis points since the same time last week.

New Listings:

New to the Market

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Upcoming Open Houses:

Don’t forget to bring me!

Open Houses this Weekend

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Recent Price Changes:

Recent Price Changes

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Featured Listings:

Featured Listings

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

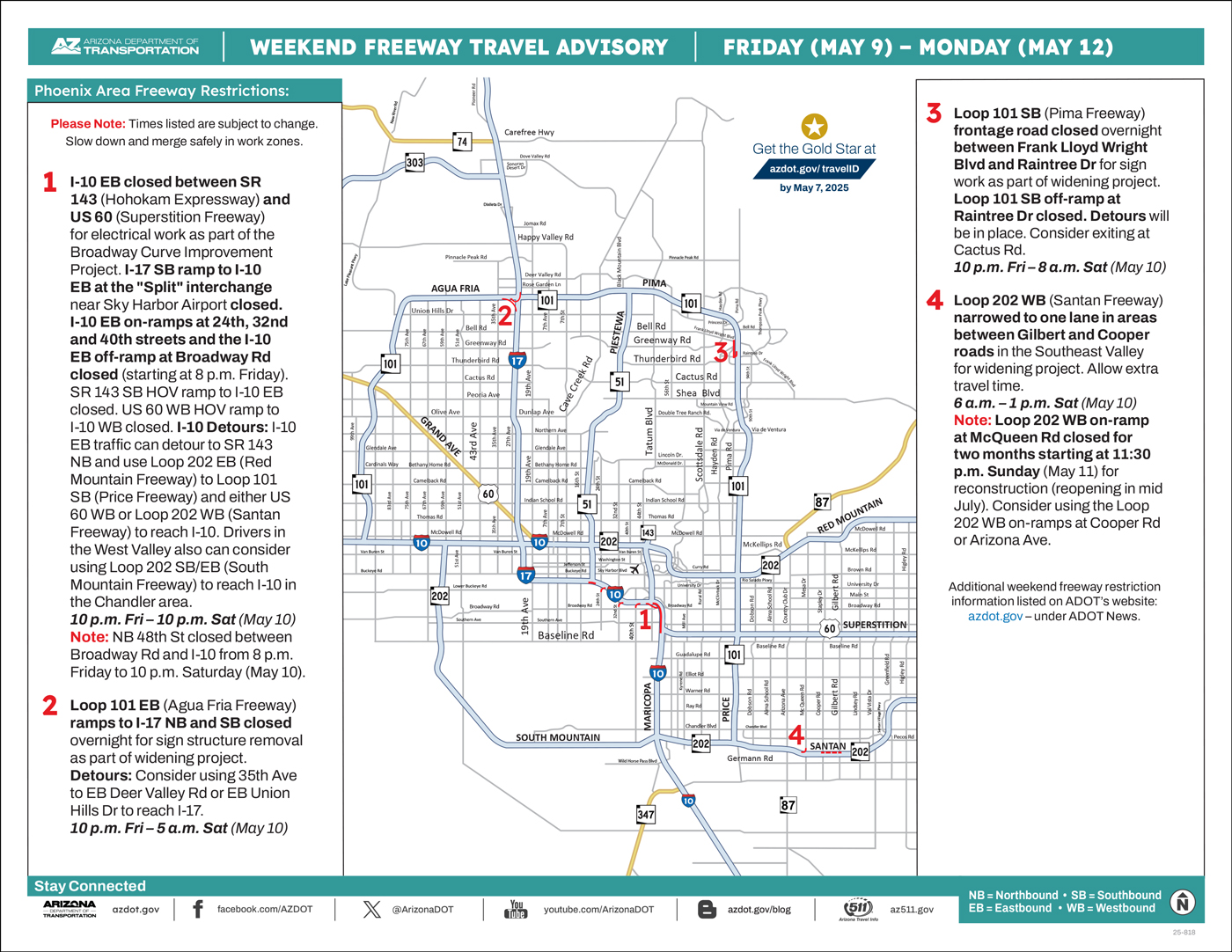

ADOT’s Weekend Freeway Travel Advisory (Nov. 3-6) – Phoenix Area

I-17 closed in north Phoenix, eastbound I-10 closed near downtown

PHOENIX – Stretches of Interstate 10 and Interstate 17 in Phoenix will be closed this weekend (Nov. 3-6) for separate improvement projects managed by the Arizona Department of Transportation, Arizona Public Service Co. (APS) and Valley Metro. Drivers, including those traveling to NASCAR events in the West Valley, should consider using alternate routes if necessary while the following weekend closures are in place:

- Southbound I-17 closed between Loop 101 and Bell Road in north Phoenix from 10 p.m. Friday to 5 a.m. Monday (Nov. 6) for APS powerline work. Southbound I-17 on-ramp at Rose Garden Lane and both Loop 101 ramps to southbound I-17 closed. Expect delays and allow extra travel time.

- Detours: Drivers can consider using eastbound Loop 101 to southbound SR 51 as an alternate freeway route to the downtown Phoenix/Sky Harbor Airport area. Local detour routes include exiting ahead of the closure and using southbound 19th or 35th avenues to travel beyond closure.

- Special Traffic Alert: If you normally would use I-17 in north Phoenix to travel toward NASCAR events in the West Valley, consider other routes including westbound/southbound Loop 303 to I-10. Allow extra travel time, especially along southbound I-17 approaching Loop 101.

- Northbound I-17 closed between Dunlap Avenue and Union Hills Drive from 10 p.m. Friday to 5 a.m. Monday (Nov. 6) for APS powerline work and Valley Metro’s light rail bridge project. Northbound I-17 on-ramps at Bethany Home Road, Glendale Avenue and Northern Avenue closed.

- Detours: Drivers can consider using northbound SR 51 to westbound Loop 101 as an alternate freeway route to travel beyond closure. Local detour routes include exiting ahead of the closure and using northbound 19th or 35th avenues to travel beyond closure.

- Please Note: Eastbound I-10 is closed this weekend between the I-17 “Stack” interchange and Seventh Street near downtown Phoenix.

- Eastbound I-10 closed between the I-17 “Stack” interchange (near 35th Avenue) and Seventh Street from 10 p.m. Friday to 10 a.m. Sunday (Nov. 5) for bridge inspections and tunnel maintenance. Both I-17 ramps to eastbound I-10 closed.

- Detours: Eastbound I-10 traffic can detour to southbound I-17 and connect with I-10 at the “Split” interchange near Sky Harbor Airport.

- Priest Drive closed in both directions overnight at US 60 (Superstition Freeway) from 8 p.m. Friday to 4 a.m. Saturday (Nov. 4) for construction.

- Detour: Consider alternate routes including Mill Avenue.

Schedules are subject to change due to inclement weather or other factors. ADOT plans and constructs new freeways, additional lanes and other improvements in the Phoenix area as part of the Regional Transportation Plan for the Maricopa County region. Most projects are funded in part by Proposition 400, a dedicated sales tax approved by Maricopa County voters in 2004.

Real-time highway conditions are available on ADOT’s Arizona Traveler Information site at az511.gov and by calling 511. Information about highway conditions also is available through ADOT’s Twitter feed, @ArizonaDOT.

Valley of the Sun Sold Listings

- 7050,7601,6318,6209,5731,5487,5833,5158,5583,4731,5817,6954

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Inventory

- 19843,20236,20563,20331,20280,21356,23131,24234,23021,23572,25733,27480

- 9621,9474,8192,7689,8817,9001,9409,7451,6073,11120,10466,11301

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings

- 9621,9474,8192,7689,8817,9001,9409,7451,6073,11120,10466,11294

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Pending Listings

- 7188,6637,5977,5646,5598,5649,5604,5050,4530,6302,6653,6494

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Absorption Rate

- 3.32,3.37,3.45,3.46,3.44,3.65,3.96,4.11,3.88,3.93,4.28,4.56

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Sale to Original List Price Ratio

- 96.1,96.2,96.1,96.0,95.6,95.8,96.0,95.8,95.3,95.4,95.8,95.8

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Average Days on Market

- 66.0,64.7,65.2,66.8,71.1,70.3,71.9,71.1,75.7,81.5,80.0,77.6

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings Volume

- 6336656755,6070361412,4981802722,4528549389,5505279350,6181215417,6408533461,4990243000,3989362142,8345736804,7206202963,7764958223

Information is deemed to be reliable, but is not guaranteed. © 2025

National Real Estate News

I’ll be honest, it’s been a real bummer sharing mostly discouraging news about the housing market over the past few weeks. While this week is not quite rainbows and cupcakes, there is good news to share for buyers (a big move down in mortgage rates) and sellers (home prices continue to rise). It’s Thanksgiving month, so let’s be grateful for small things too.

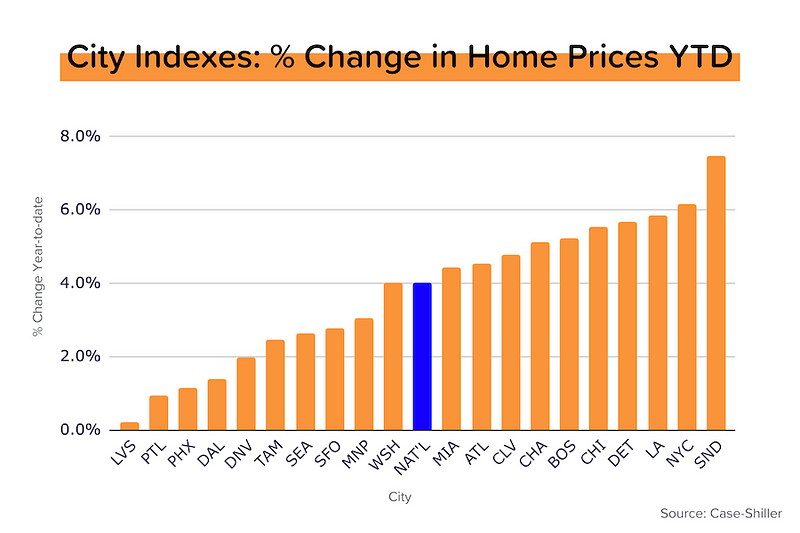

Case-Shiller Index makes it 7 in a row. The national home price index rose 0.9% MoM in August 2023, an acceleration from +0.7% in July 2023. Prices have already risen 4% year-to-date, and are 1.5% above their previous peak in mid-2022. More details on the individual city indices below. [S&P Global]

FHFA Index makes it 12 in a row. Home prices rose 0.6% MoM in August 2023, a deceleration from +0.8% in July 2023. Prices have risen 6% year-to-date, and are 4.7% above their previous peak in mid-2022.

Wondering why these two are always a bit different? Like Case-Shiller, the FHFA index tracks transaction pairs, the most accurate way to measure home price appreciation. But the FHFA index only looks at transactions financed with a conforming mortgage. So no all-cash transactions, and no jumbo loans.

That sinking feeling in Europe. Eurozone GDP contracted 0.1% in the 3rd quarter. The German, Irish and Austrian economies all went backwards, while France barely grew. “Headline” Eurozone inflation, meanwhile, fell more than expected to +2.9% YoY, and “core” inflation dropped from 4.5% to 4.2% YoY.

Still adding jobs, just slower. ADP’s monthly employment report showed that private employers added 113,000 jobs in September. For most of 2023, the 3-month average was >200,000. Wage growth slowed further, but remained elevated at +5.7% YoY for job stayers and 8.4% for job leavers. A year ago, those figures were +7.7% & +15.4%, respectively. [ADP]

What the Fed said. The Federal Reserve kept its policy rate steady at 525–550 basis points (5.25–5.50%) for the second-straight meeting. This, in and of itself, is ‘dovish,’ notwithstanding Chairman Powell’s usual rhetoric.

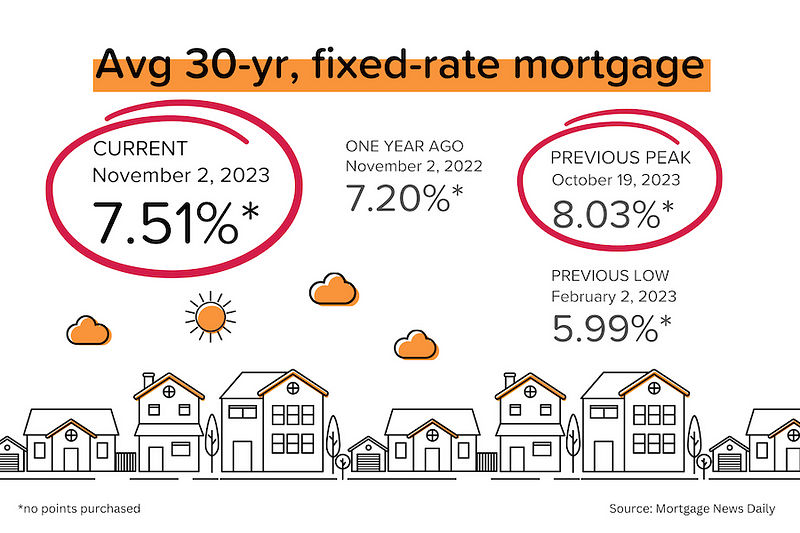

The bond market liked it. Even though pretty much everyone expected the Fed to do nothing, bond prices still rallied aggressively (pushing yields lower). How much of that was the weaker-than-expected ADP and ISM data versus Powell’s press conference we’ll never know, but average 30-year mortgage rates dove to 7.51%.

On the Case (Shiller)

The mass media tends to focus on Case-Shiller’s national price index. That’s understandable, but real estate is a local game, so let’s dive into the big city indexes:

- 10 of the 20 individual big city indices set new all-time highs. Chicago and New York are already 5% above their mid-2022 peaks. Cleveland is 4% above.

- San Diego prices are up 7.5% ytd! New York City is +6.1% ytd. None of the 20 big city indices are down ytd.

- Los Angeles, San Diego, and Tampa Bay are VERY CLOSE to setting new highs. It is highly likely that all three will hit new highs next month.

- San Francisco (-9.4%), Seattle (-7.3%), Las Vegas (-6.5%), and Phoenix (-6.1%) are still well below their mid-2022 peaks, but Seattle and Las Vegas are rebounding quickly.

Reminder: We pay extra attention to the Case-Shiller index because it provides the most accurate measure of home price appreciation. By tracking large numbers of transaction pairs (e.g. House A sold in October 2017 at $300,000 and again in January 2024 at $550,000), the Case-Shiller index comes closest to measuring ‘true’ appreciation. Many of the other home price measures are skewed by the mix (high-end vs. low-end) of properties being sold during the period.

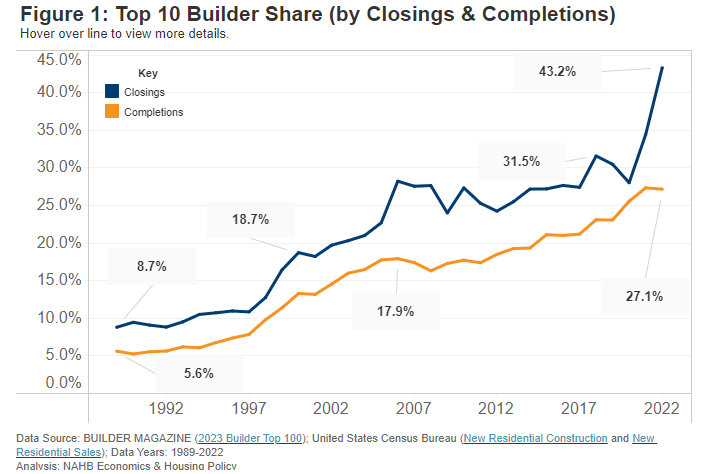

Biggest Builders Getting Bigger and Public-er (Sorry)

In 1989, the Top 10 builders represented just 9% of new home sales nationwide. In 2000, this had doubled to 19%. And by 2022, it had doubled again to an incredible 43% of unit sales! And the Top 20 represented 53% of all sales. The homebuilding industry is becoming increasingly concentrated.

In 2022, nine of the Top 10 builders were publicly-listed. And 17 of the Top 20 builders were publicly-listed. In other words, most of these Top 20 builders have a share price that changes daily. They have to think about increasing shareholder value (getting the stock price up, paying dividends, or buying back shares.) And executive compensation is often tied to the share price in one of various ways. The homebuilding industry is increasingly public (listed.)

I’m not saying that going public is bad. But I analyze public companies and I know for sure that public companies behave differently than private companies. Public companies don’t build homes out of the goodness of their hearts. They build homes because they believe they’ll generate a solid margin and a strong return on invested capital.

In a way, we’re increasingly reliant on public companies (listed builders) to provide a public good (new homes to address the housing shortage.) Hmmmm. Want to check out new homes without being hounded? Browse here and if you want to go look at new builds, take me with you!

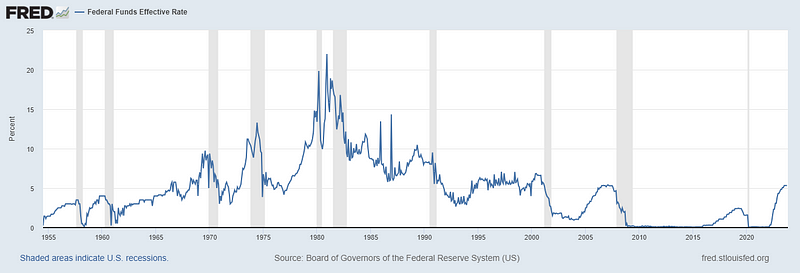

When the Fed stops

It’s possible that this time is different. But it usually isn’t. After an aggressive Fed tightening cycle, rates rarely stay ‘higher for longer,’ and the landings are scarcely ‘soft.’ And as a reminder, this has been a very aggressive Fed tightening cycle by historical standards.

The blue line in the graph below is the effective federal funds rate. The light gray bars indicate recessions. Do you see what I see?

- A sharp price in the fed funds rate almost always precedes (precipitates?) a recession.

- ‘Higher for longer’ is standard verbiage from the Fed, but just try to find it on the graph. (The closest is the plateau between 2007–2008.) ‘Overdid it and now regret it’ seems more common.

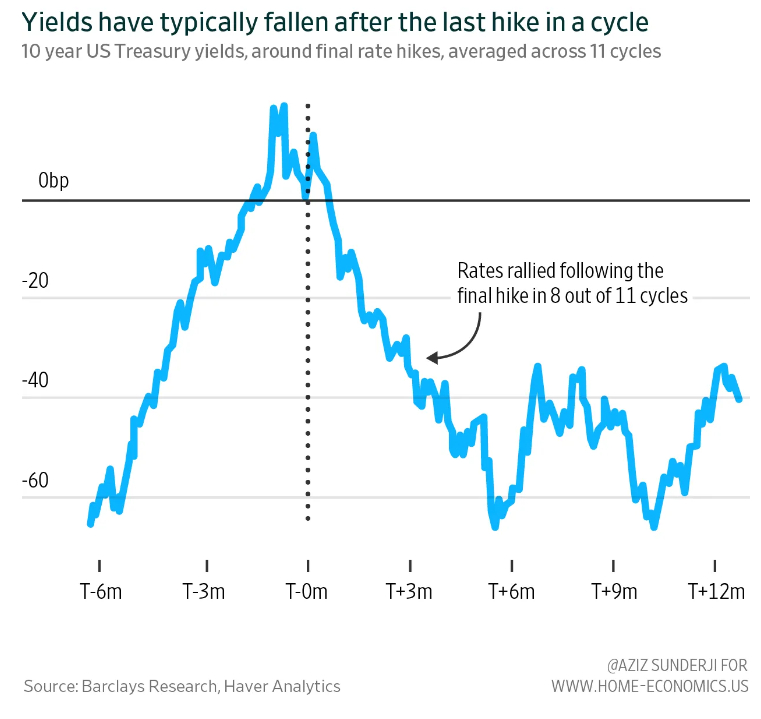

No matter what Federal Reserve Chairman Jerome Powell says, we’re nearing the end of this rate tightening cycle. And when the Fed stops, US treasury bond yields (and mortgage rates) usually have a big move lower. What we’ve seen over the past few days might well be part of that, as the market interprets the Fed’s double ‘skip’ as an unspoken ‘stop.’ [Thanks to my friend Aziz from Home Economics for the chart below.]

Mortgage Market

Bond movements have shaved more than half a percent off average mortgage rates in the past few days. Look, 7.5% is still a big number, but let’s just be happy that it’s lower than 8%.

The next FOMC (Federal Open Market Committee) meeting is on December 13. At the moment, the market is only putting a 15% probability on another +25 bps rate hike. In other words, the market is putting an 85% probability on a third-straight pause.

They Said It

“No single industry dominated hiring this month, and big post-pandemic pay increases seem to be behind us. In all, October’s numbers paint a well-rounded jobs picture. And while the labor market has slowed, it’s still enough to support strong consumer spending.” — Nela Richardson, ADP Chief Economist

“On a year-to-date basis, the National Composite has risen 5.8%, which is well above the median full calendar year increase in more than 35 years of data. The year’s increase in mortgage rates has surely suppressed housing demand, but after years of very low rates, it seems to have suppressed supply even more. Unless higher rates or other events lead to general economic weakness, the breadth and strength of this month’s report are consistent with an optimistic view of future results.” — Craig Lazzara, S&P Global Managing Director

Here’s your links for this weekend’s events!

My Website always has a list of what’s upcoming. Go here and maybe I’ll see you out there!

Get your Home Value, wealth Snapshot and Ideas what to do with your Equity Every Month!

Join DeDe’s Secret Private Facebook group for tips, tricks, discounts and Freebies!

DeDe’s Social Media: Click on picture to read/watch

What’s Going on with DeDe?

This week, the kids got their first visit by Trick or treaters! They did great! For a while, then the trick or treating dogs and feral cats showed up. Then they watched from outside! 2600 pieces of candy given out at Casa De DeDe!

Darci stole a stuffed animal from me and adopted her new best friend! So funny to watch her drag this bear around that’s bigger than her!

Arizona Fall League is winding down! I’m getting to as many games as I can. Check the schedule and maybe I’ll see you out there! Go Glendale Desert Dogs!

That’s all for this week’s edition of the newsletter! Know I am always here for any questions you have about Buying, Selling, or Investing in Residential Real Estate! HomeOwnership too! Vendors and Tradespeople too! Don’t hesitate to Reach out

See you next Week!

DeDe